Taxable income formula

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. For clients with provisional income over 44000 joint A The portion of income between 32000 and 44000 is taxed according to the pre-93 rules at 50 amounting to.

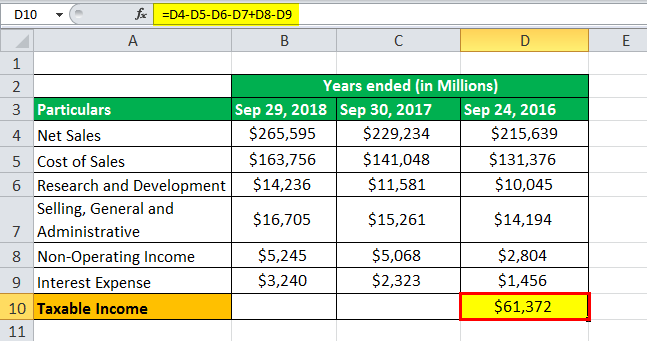

Income Tax Formula Excel University

This list serves as a guide and is not intended to replace.

. Taxable income total income gross income - exempt income - allowable deductions taxable capital gains. Taxable income starts with gross income then certain allowable. Taxable Income - With Calculation and Examples Provided All about Taxable Income in India.

Ad See If You Qualify To File For Free With TurboTax Free Edition. The first 9950 is taxed at 10 995. View a list of items included in Michigan taxable income.

Taxable income is all income subject to Michigan individual income tax. Gross Income x Tax Rate Taxable Income Calculating Taxes. Income from business or property.

Determine Provisional Income 12 of a. Income from capital gain tax. An amount of money set by the IRS that.

The next 30575 is taxed. Gross income is all income from all sources that isnt specifically tax-exempt under the Internal Revenue Code. Allowable deductions from gross income including certain employee personal retirement insurance and support expenses.

Income Tax Payable for an. 1 Minimizing Taxable Income 2 Losses and Taxable Income 3 The Difference in Financial Accounting and Tax Code Conclusion Recommended Articles Formula The. You can use the worksheet in IRS Publication 915 fill out a 1040 or use this formula to calculate the taxable portion of Social Security benefits.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Therefore the taxable income becomes more than 57000 510006000 calculated with the same tax rate of 35. This puts you in.

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. Federal taxes State taxes Total Taxes 75K views How to Calculate Taxable Income The gross income is. Unless a particular income is expressly exempted by law from tax liability every income is taxable and should be reported in the income tax return.

That puts your taxable income at 70150 thats your AGI of 83000 minus the 12550 standard deduction minus the 300 in qualifying cash donations. Partner with Aprio to claim valuable RD tax credits with confidence. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The tax payable will be thus 19950. Gross income is the amount of worldwide income that you earned during the tax.

As per the Income Tax Act 1961 income tax is levied on. It is the gross income of an individual or company that is applicable for tax levy.

Taxable Income Formula Examples How To Calculate Taxable Income

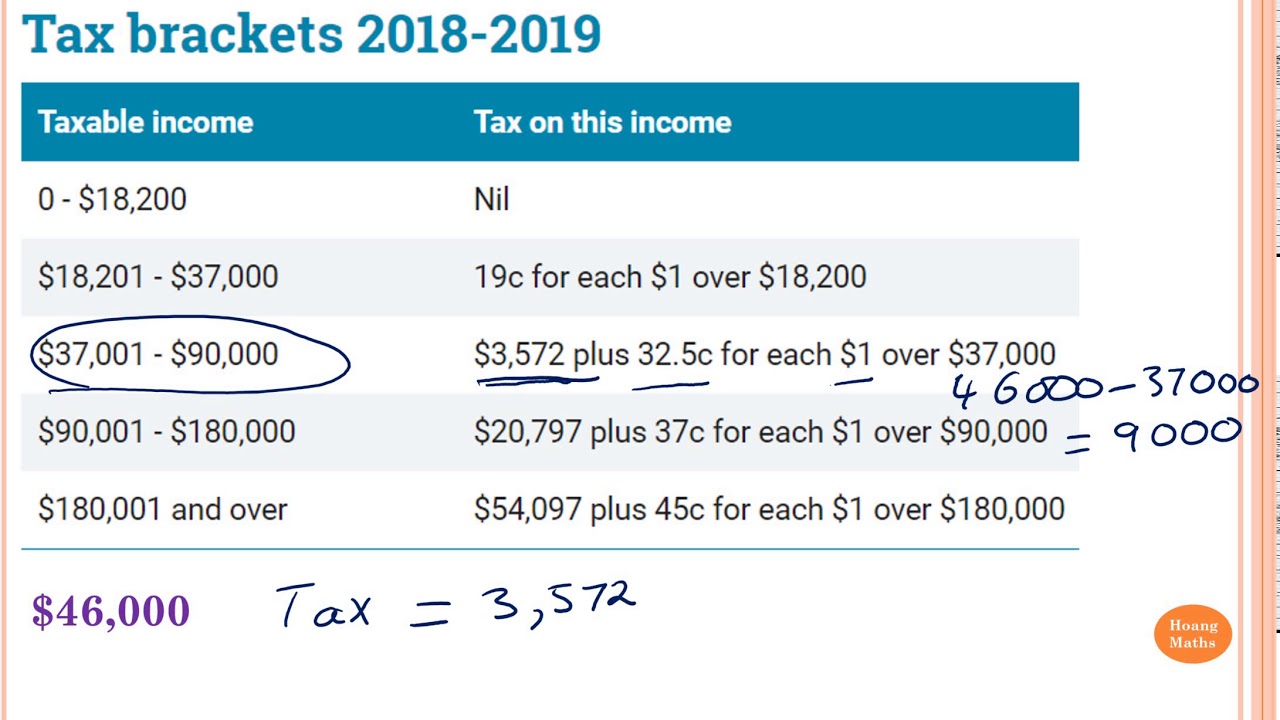

Calculating Tax Payable Part 1 Youtube

Taxable Income Formula Calculator Examples With Excel Template

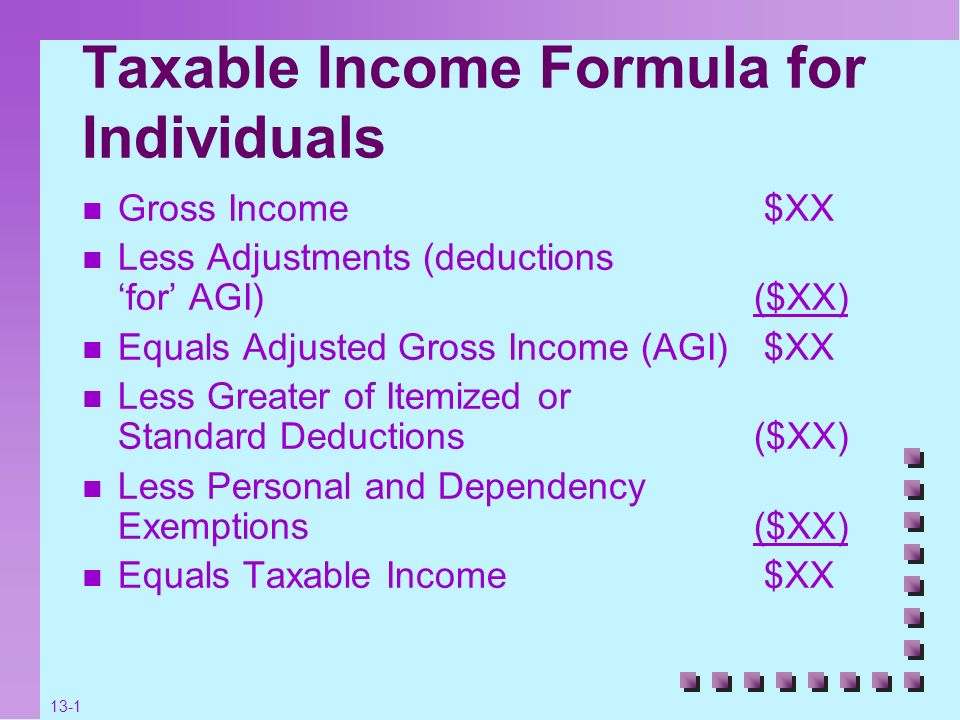

Taxable Income Formula For Individuals Ppt Video Online Download

Taxable Income Formula Calculator Examples With Excel Template

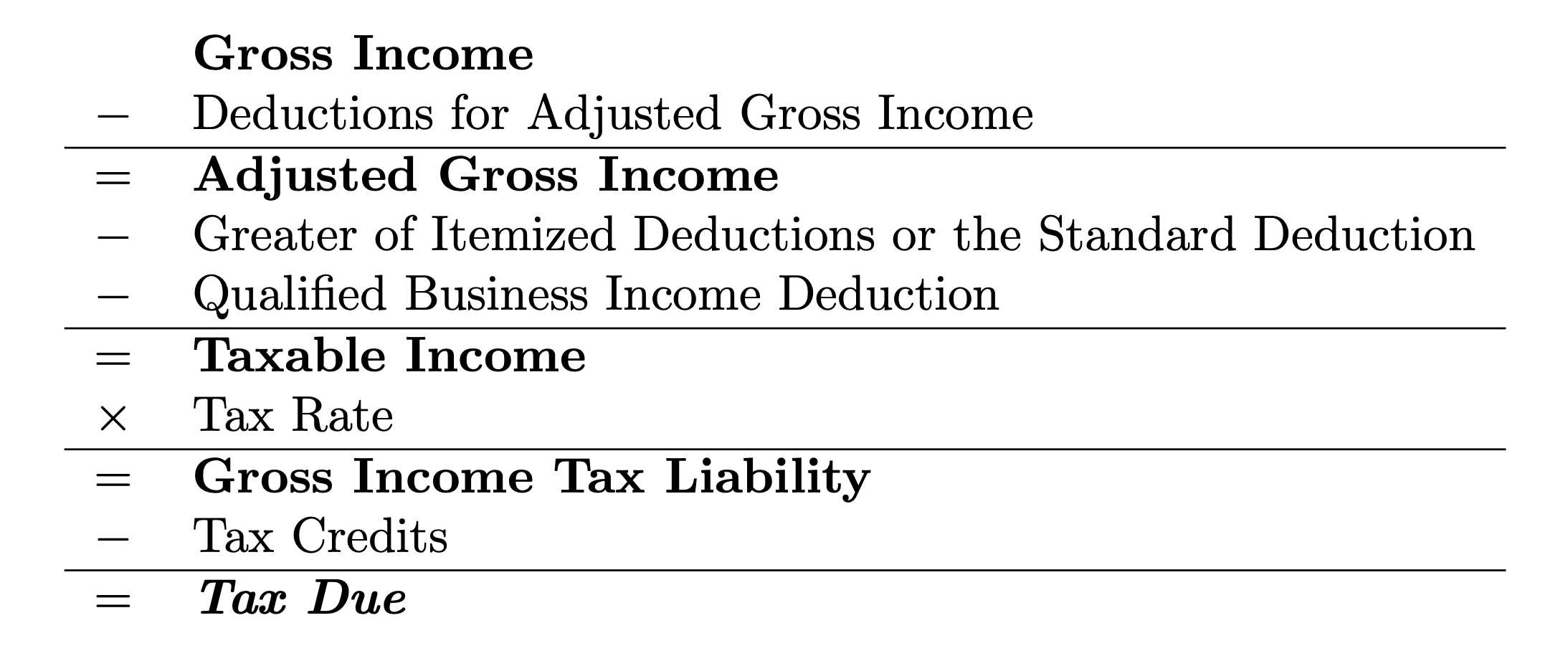

File Us Income Tax Formula Basic Png Wikipedia

California Tax Expenditure Proposals Income Tax Introduction

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income What Is Taxable Income Tax Foundation

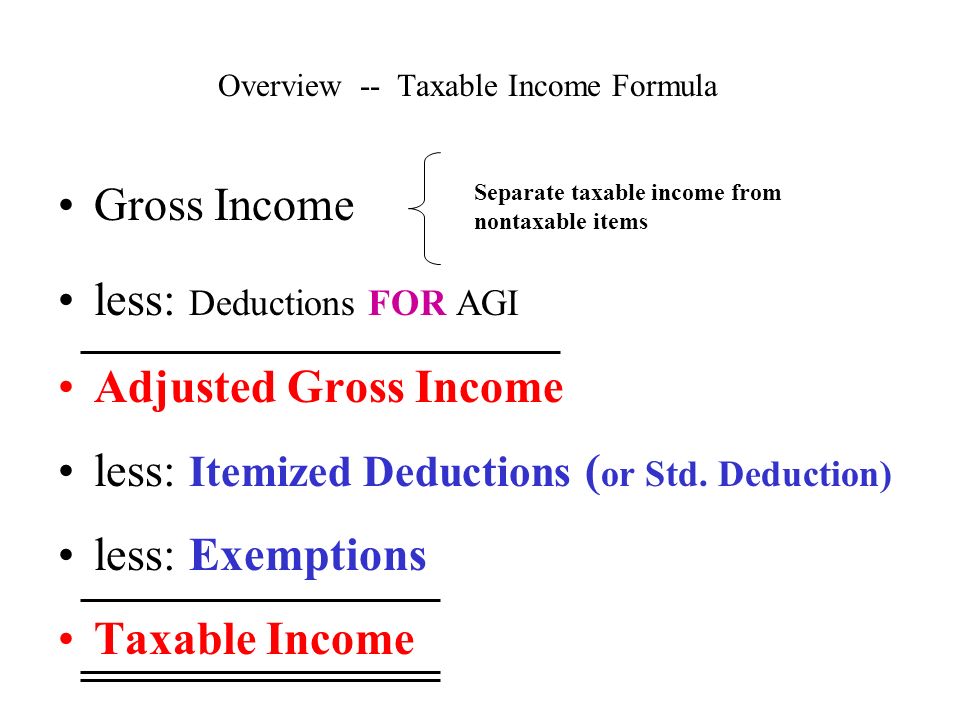

Chapter 3 Calculate Taxable Income Personal And Dependency Exemptions Ppt Video Online Download

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Standard Deduction Tax Exemption And Deduction Taxact Blog

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income