Part time income calculator

As of Jul 21 2022 the average annual pay for a Part Time in the United States is 26950 a year. If your filing status is single married filing separately or head of household you will get taxed 2 on your first 500 of taxable income 4 on earnings up to 3000 and 5 on income over that.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

So a freelancer with a day rate of 150 would have a pro rata salary of 39000.

. Your average tax rate is 1198 and your marginal tax. Its really designed to help you answer the question have I saved. The Retirement Budget Calculator is designed for those about to retire or at least within 5 years of retirement.

Partial Unemployment Benefit Calculator If you work part time your benefits are reduced in increments based on your total hours of work for the week. If you make 70000 a year living in the region of New York USA you will be taxed 12312. To decide your hourly salary divide your annual income with 2080.

Multiply your estimated weeks of work by your weekly pay. Part-time income tax calculator. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Let The Take-Home Calculator tell you what its worth on a monthly weekly or daily basis - our tax calculator also considers NI student loan and pension contributions. Just in case you need a simple salary calculator that.

That means that your net pay will be 40568 per year or 3381 per month. Income qnumber required This is required for the link to work. 57 rows Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. But calculating your weekly take-home pay. For instance if you work 40 weeks out of the year and make 240 per week you would earn 240 40 9600 per.

In order to be eligible for partial. Posted on January 31 2022. New York Income Tax Calculator 2021.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Yes you can use specially formatted urls to automatically apply variables and auto-calculate. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

How much does a Part Time make. Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. If you do any overtime enter the number of hours you do each month and the rate you get paid at.

In the Weekly hours field enter the number of hours you do each week excluding any overtime. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. It can be any hourly weekly or.

How Your Paycheck Works.

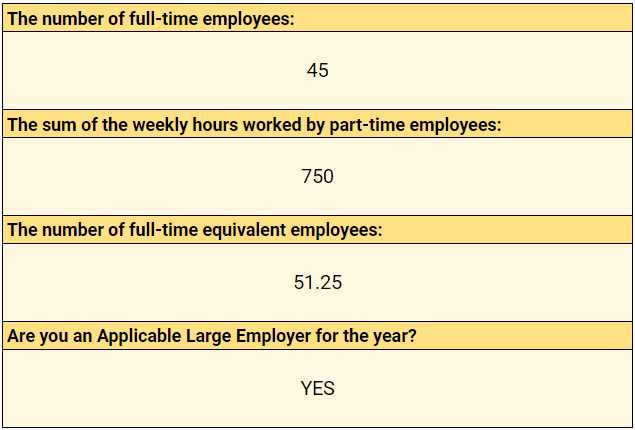

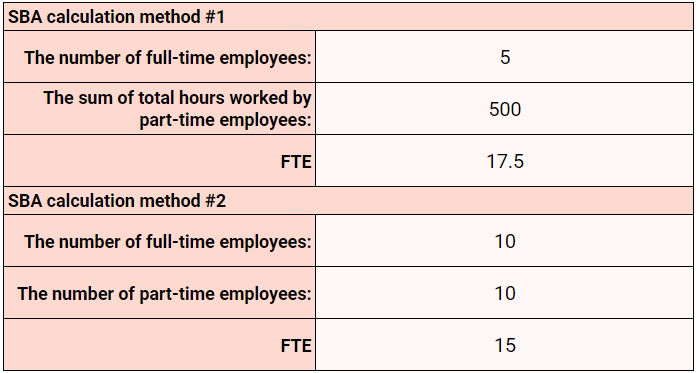

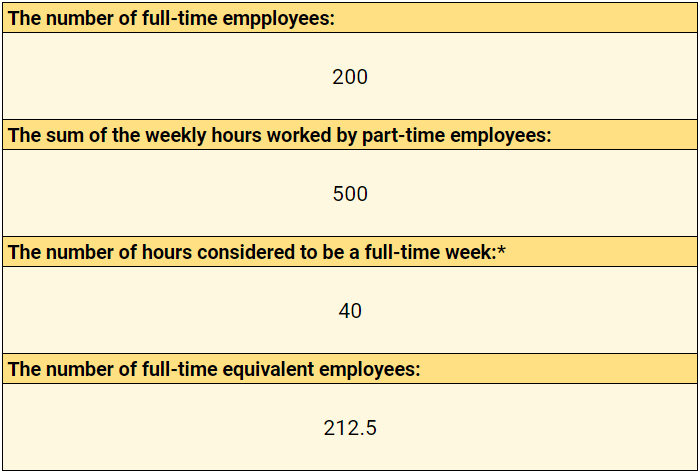

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

17 An Hour Is How Much A Year Can I Live On It Money Bliss

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Annual Income Calculator

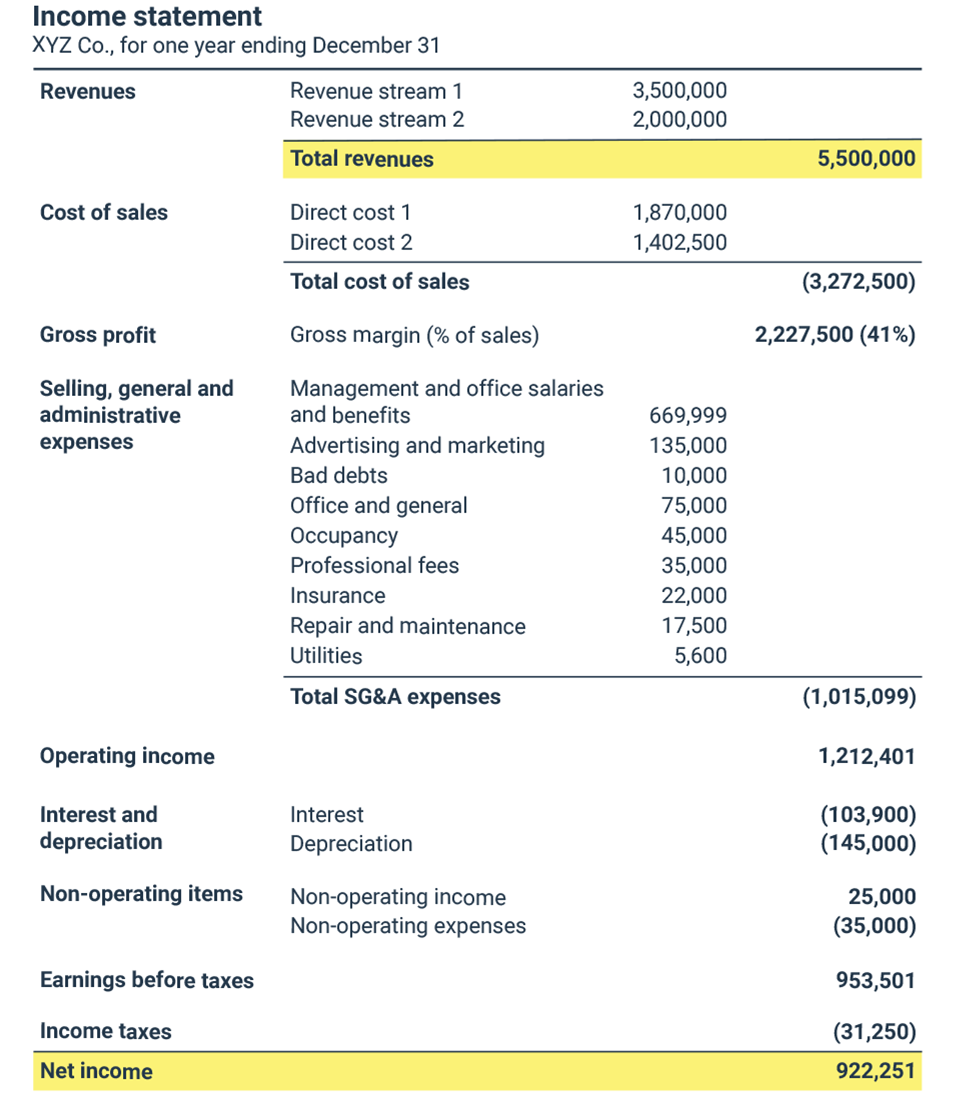

Net Profit Margin Calculator Bdc Ca

Net Profit Margin Calculator Bdc Ca

Hourly To Salary Calculator Convert Your Wages Indeed Com

What You Need To Know About An 8 Hour Workday Calculators

Hourly To Salary Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

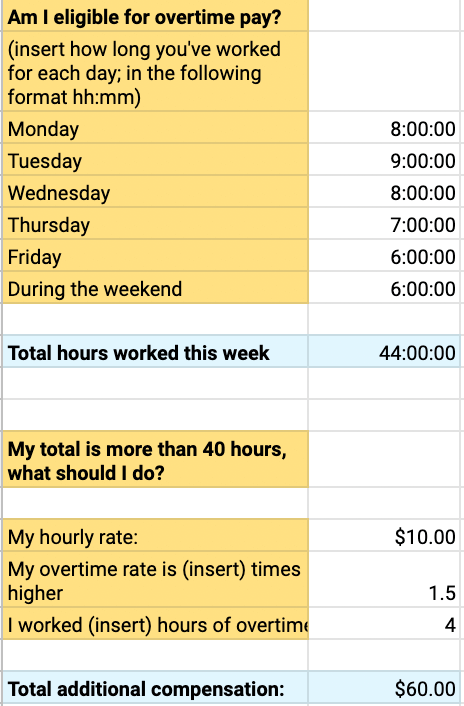

Overtime Calculator To Calculate Time And A Half Rate And More

Hourly To Salary What Is My Annual Income

Annual Income Calculator

How To Calculate Gross Income Per Month